Paralyzed or Sabotaging? Your Financial Plan is Missing One of These Two "Operating Systems"

At SafeSimpleSound, I work with intelligent, capable, and successful people. I've seen them get stuck in two distinct, but related, ways.

Does either of these sound familiar?

- Decision Paralysis. You're smart. You research. You work hard. But when faced with a complex financial choice—retiring, changing careers, investing a windfall—you feel completely paralyzed. You get stuck in an analysis loop, repeating the same mistakes, or just collapsing to the first "comfortable" option.

- Self-Sabotage. You have a good plan. You know what you should do. You value your health, your family, and your long-term security. But you consistently find yourself acting against your own wisdom. You can't seem to close the gap between knowing what's right and doing what's right.

These two problems reveal a profound truth I've built my practice on: A sound financial plan is useless without a complete human operating system to run it.

Most financial advice fails because it only gives you a "map" but ignores the "human" element. It doesn't give you the tools to think systematically, and it certainly doesn't give you the tools to be resilient.

To solve this, you need a "dual operating system." I've codified this system in two books: 'Your Four Moves' is the manual for your thinking infrastructure, and 'Contradiction-Free Living' is the manual for your inner capabilities.

Let's break down how they work together.

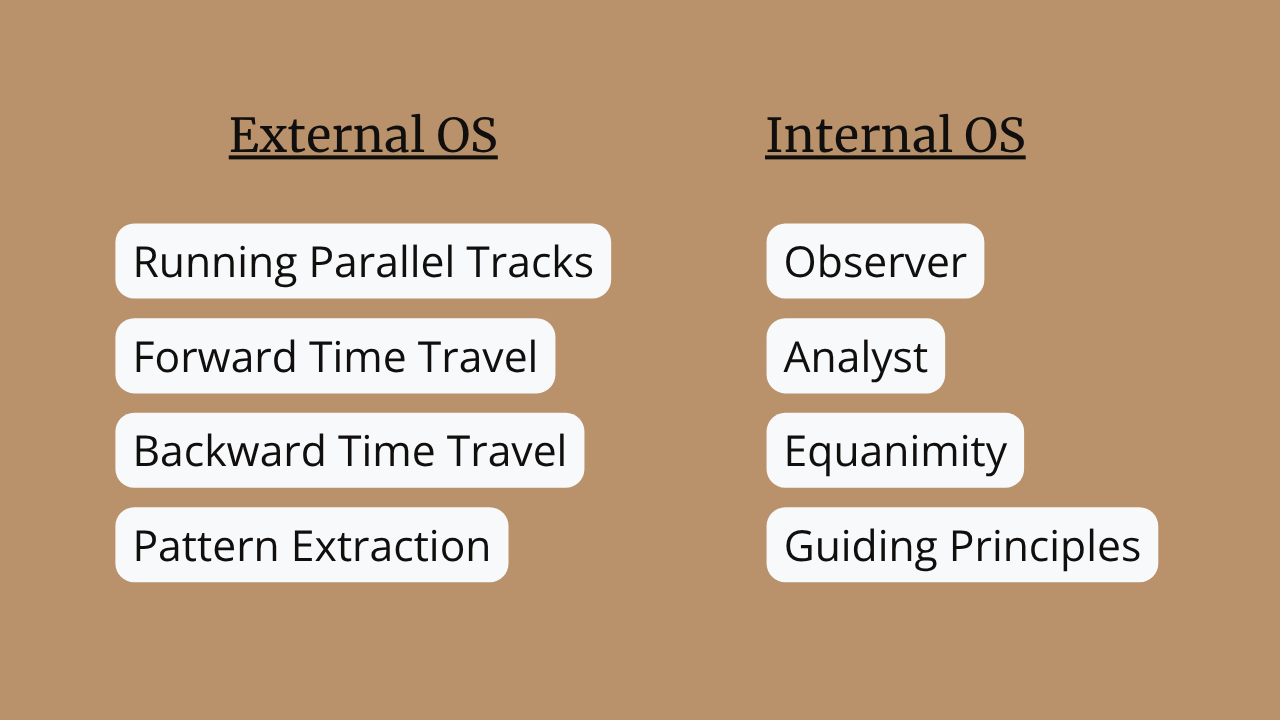

System 1: The 'External OS' (The 'How') – 'Your Four Moves'

The first problem, paralysis, isn't an intelligence problem. It's a thinking infrastructure problem.

Before I became a financial planner, I spent 20 years as a software engineer at places like PayPal and NetSuite, building reliable, complex systems. I discovered that the systematic thinking required for engineering—root cause analysis, implication projection, pattern extraction—transfers directly to every major life decision.

'Your Four Moves' is your External Operating System. It gives you the "how"—the mental operations to design a robust, technically excellent, and truly "Safe" financial plan.

It teaches four core "moves":

- Running Parallel Tracks: Instead of locking onto one path, you hold multiple options open (like a GPS showing three routes) and develop each independently, letting the right choice emerge through exploration.

- Forward Time Travel: You systematically project the implications of a decision across multiple timeframes (3 months, 3 years, 10 years) to see where a path truly leads before you commit.

- Backward Time Travel: When a problem arises, you trace it backward (using a "5 Whys" approach) to find the root cause, so you fix what's actually broken, not just the visible symptom.

- Extracting Reusable Patterns: You build a mental library of strategies that work, so you can stop starting from scratch with every new, complex decision.

This system helps you get unstuck and build a plan you can trust.

But then, a new problem emerges. What happens when you have to execute that plan?

System 2: The 'Internal OS' (The 'Why') – 'Contradiction-Free Living'

This brings us to the second problem: self-sabotage.

What happens when you have that perfect, systematically-designed plan... and the market drops 30%? What happens when you know you should save, but you feel an overwhelming emotional impulse to spend?

This is where your thinking system gets hijacked by your internal state. This is the "knowing-doing gap."

'Contradiction-Free Living' is your Internal Operating System. It provides the "why"—the inner capabilities you need to execute your plan with integrity, especially when it's difficult.

It teaches three foundational capabilities:

- The Observer: The ability to notice your thoughts, emotions, and reactions in real-time without being swept away by them. This creates the critical space between a stimulus (like a scary headline) and your response, allowing conscious choice.

- The Analyst: Not a financial analyst, but an inner analyst. This is the ability to trace your behaviors back to their root causes with compassionate curiosity rather than harsh judgment.

- Equanimity: This is the game-changer in finance. It's the ability to maintain inner stability when facing difficulty, discomfort, and uncertainty. It allows you to hold the reality of risk without collapsing into panic.

This Internal OS makes your plan emotionally and psychologically sustainable. It's the "Simple"—though not easy—framework for authentic integrity.

The Both/And Solution: A Truly "Sound" Financial Life

This is the core philosophy of SafeSimpleSound. You need both.

- 'Your Four Moves' is the sophisticated navigation software that maps out the absolute best financial route.

- 'Contradiction-Free Living' is the skilled driver who has the stability, presence, and clarity to stay on that route when the storm hits.

Most financial advisors only give you the map—and it's often a generic one. They don't give you the thinking tools to co-create it (YFM), and they certainly don't give you the inner tools to handle the emotional journey of executing it (CFL).

A truly "Sound" financial life is built at the intersection of both. It's a life where your actions align with your wisdom, and your plan is strong enough to handle reality.

Where Are You Stuck?

Your financial life is a complex human system. It requires a complete human operating system to manage it.

So, I invite you to ask yourself: Where are you stuck?

- Are you paralyzed by complexity and unable to choose a path? 'Your Four Moves' is your starting point.

- Are you acting against your own wisdom and unable to execute your plan? 'Contradiction-Free Living' is where you must begin.

If you'd like to explore how to apply this dual system directly to your financial life, that is the constitutional work we do every day at SafeSimpleSound.

Learn more about the books:

- For systematic thinking: Your Four Moves

- For inner capabilities: Contradiction-Free Living

Explore our approach:

- To apply these frameworks to your financial life, visit us at SafeSimpleSound.com