Course: First 30 Days

Your New Business Tax Setup In The First 30 Days

Course Overview

Stop letting the "LLC question" paralyze your business launch.

This FREE course transforms the overwhelming process of starting a business into four decisive actions you can take confidently—whether you ever work with us or not.

Course Length: Under 10 minutes of dense, visual instruction

Format: Self-paced video modules with visual frameworks

Investment: FREE (Educational Generosity in Action)

Includes: Complete S3 New Business Compliance Checklist (PDF)

REGISTER FOR FREE COURSE: https://lucky-lion.webinarninja.com/app/courses/7008/registration

The Problem This Solves

You're ready to launch your business. You have the skill, the drive, and the vision. But you're stuck on the starting line, paralyzed by contradictory advice:

- "Just start!" vs. "Get your structure perfect first!"

- "You NEED an LLC!" vs. "Sole proprietorships are fine!"

- "S-Corps save taxes!" vs. "S-Corps are too complex for Year One!"

Every piece of advice feels equally urgent and equally confusing. This is the "Permanence Trap"—the false belief that your first decision is your forever decision.

The result? Analysis paralysis. Anxiety. Delayed launch.

The SafeSimpleSound Solution

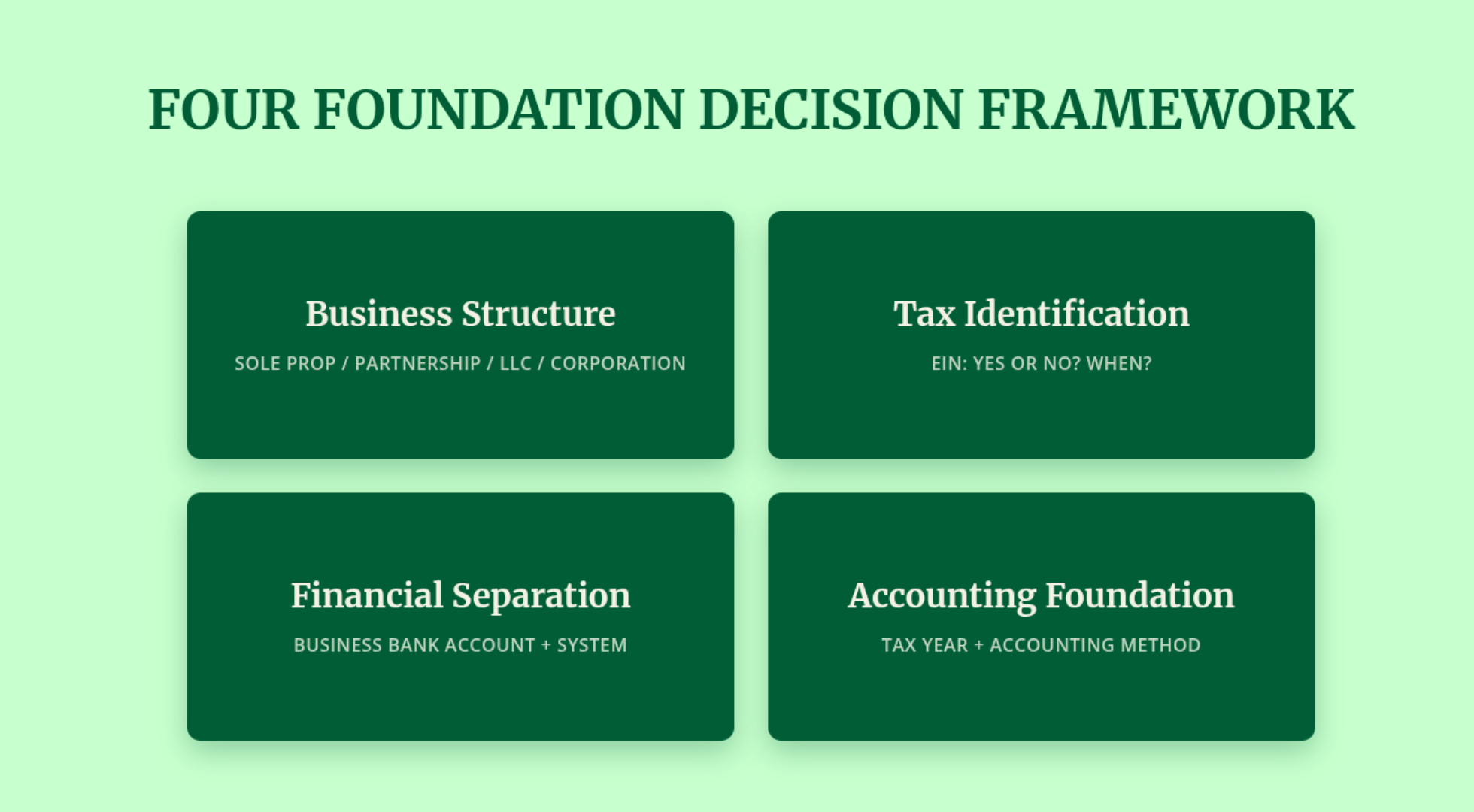

This course provides the Four Foundation Decisions Framework—a systematic approach to making your first 30 days of business setup decisions with confidence and clarity.

The Insight: Your business structure is not a permanent identity. It's an evolutionary operational decision for THIS STAGE of your business.

You don't have to choose between launching quickly OR building the right foundation. You can have both.

What You'll Learn

The Four Foundation Decisions Every New Business Must Make:

Decision #1: Business Structure

Discover the systematic process for choosing between Sole Proprietorship, LLC, Partnership, or Corporation for YOUR Year One—based on your actual situation, not generic advice.

Key Framework: The two-question decision tree that eliminates structure confusion:

- Are you doing this alone or with partners?

- What's your primary concern: simplicity/low cost or liability protection?

Decision #2: Tax Identification (EIN)

Key Framework: The safety-first EIN strategy that protects your Social Security Number while preparing for future growth.

Decision #3: Financial Separation

Master the non-negotiable foundation piece that 80% of new business owners delay—and pay for later.

Decision #4: Tax Year & Accounting Method

Understand the automatic defaults for your business and when they apply.

Key Framework: The foundation-level tax framework that most new business owners don't even know they're choosing.

The Safety Net

"What if I choose wrong?"

This course explicitly addresses the fear beneath every setup decision. You'll discover:

- Why "integration over abandonment" means you build ON your foundation, not tear it down

- The real consequences of early mistakes (spoiler: they're fixable, not catastrophic)

The result: You move forward with confidence, knowing you can adapt as you grow.

What's Included

✅ Complete Video Course (Under 10 Minutes)

Dense, visual instruction covering all four foundation decisions with systematic frameworks and decision trees.

✅ S3 New Business Compliance Checklist (PDF)

Your step-by-step implementation guide with:

- The Four Foundation Decisions summary

- 10 critical questions every new business owner must answer

- Action timeline for your first 30 days

✅ Lifetime Access

This course and checklist are yours permanently. Revisit anytime as your business evolves.

Who This Course Is For

Perfect for:

Aspiring Entrepreneurs (Pre-Launch)

- You have a product or service ready to market

- You're paralyzed by business setup decisions

- You want to launch correctly WITHOUT over-engineering Year One

New Business Owners (0-6 Months)

- You've already started but want to verify your foundation is sound

- You're experiencing "Did I do this right?" anxiety

- You want to course-correct before tax filing season

Side Hustle Professionals

- You're scaling a side business and need to "go legit"

- You're worried about missing critical registrations

- You want to separate personal and business finances systematically

NOT Ideal for:

- Established businesses with complex partnerships (you need specialized legal counsel)

- Companies with significant investor capital (different structure requirements)

- Businesses requiring specialized licensing (additional regulatory compliance needed)

What Makes This Course Different

Constitutional vs. Generic Business Setup Advice:

Generic Business Formation Services:

- Sell LLC packages ($299-500) with no education

- Provide checklists with no decision framework

- Zero ongoing support or guidance

Generic "How to Start a Business" Courses:

- Overwhelming information dumps (2+ hours)

- No systematic decision framework

- Generic advice that doesn't adapt to your situation

Your First 30 Days Constitutional Course:

- ✅ Complete decision framework you can implement immediately

- ✅ Systematic thinking process (ChFC® + software engineering precision)

- ✅ Under 10 minutes of dense, visual instruction

- ✅ Free implementation checklist with all key resources

- ✅ Educational generosity—complete value whether you become a client or not

Your Instructor: Phani Kandula, ChFC®

Chartered Financial Consultant® with 20+ years bridging technology and finance

I developed the S3 (SafeSimpleSound) approach after seeing countless entrepreneurs paralyzed by business setup contradictions:

- Fast launch vs. correct foundation

- Simple structure vs. tax optimization

- DIY confidence vs. professional guidance

My software engineering background means I see business setup as designing your "operating system"—systematic, logical, and built to scale.

My Promise: This course gives you the same Four Foundation Decisions framework I use with paying clients. It's not a "teaser"—it's the complete methodology.

Your Next Steps After This Course

Option 1: Implement Independently (DIY Path)

Use the Four Foundation Decisions framework and S3 Compliance Checklist to build your business foundation yourself. This course gives you everything you need.

Option 2: Personalized Guidance (Supported Path)

If you want me to BUILD this foundation WITH you for your specific situation, the Clarity Diagnostic™ is the natural next step.

The Clarity Diagnostic is:

- A genuine 30 minute planning conversation (not a sales pitch)

- An examination of how your business foundation integrates with your complete financial life

Outcome: Crystal-clear action plan + optional ongoing S3 relationship

Course Enrollment

This Course Is 100% FREE

Why Free?

Because I believe in educational generosity. This isn't a "lead magnet" or "loss leader"—it's a complete, actionable framework that demonstrates how S3 constitutional thinking resolves business setup contradictions.

You'll gain genuine value whether you ever become a client or not. That's the promise.

Registration Required:

To deliver the course and send you the implementation checklist, I need your name and email. That's it.

What You'll Receive:

- Immediate course access

- S3 New Business Compliance Checklist (PDF download)

- Optional invitation to monthly constitutional business newsletter

You're in control: Unsubscribe anytime with one click. No spam. No pressure. Just genuine educational value.

Frequently Asked Questions

"Is this really free? What's the catch?"

Yes, it's genuinely free. The "catch" is that I'm demonstrating educational generosity because it's the right thing to do AND it builds trust with people who might become clients later. But the course stands on its own—complete, actionable value regardless.

"I've already started my business. Is this still useful?"

Absolutely. If you're in your first year, this course helps you verify your foundation is sound and course-correct if needed. The "What if I chose wrong?" section specifically addresses this.

"Do I need prior tax or business knowledge?"

No. I speak your language, not IRS language. My ChFC® and software engineering background means I translate complex concepts into clear, systematic frameworks anyone can understand.

"How long do I have access to the course?"

Forever. This course and the checklist are yours permanently. Revisit anytime as your business evolves.

"What if I have questions after the course?"

You can hit reply to any implementation email and ask. I read every response. For more comprehensive support, the Clarity Diagnostic is available when you're ready.

"Will you try to sell me something?"

No sales pitch. The course is complete value. The implementation emails provide additional tips, not sales pressure. The Clarity Diagnostic is mentioned as an optional next step for personalized guidance—but only if and when you want it.

Ready to Build Your Constitutional Foundation?

Transform business setup anxiety into decisive action in under 10 minutes.

REGISTER FOR FREE COURSE: https://lucky-lion.webinarninja.com/app/courses/7008/registration

What You Get:

✅ Complete Four Foundation Decisions framework

✅ Visual, systematic instruction (under 10 minutes)

✅ S3 New Business Compliance Checklist (PDF)

✅ Implementation email support

✅ Lifetime access

What It Costs: $0 (Free educational generosity)

Questions?

Email: hello@safesimplesound.com

This course serves you whether you ever become a client or not. That's constitutional educational generosity.